Public capital goes beyond tangible public assets. It also includes less tangible forms of capital, like natural, human, and social capital. Decisions made by public officials tend to be influenced by financial considerations and overlook potentially substantial costs in other domains, like natural or social capital. When decisions made in the public interest respond to only part of the public capital ledger, they can result in a net loss of public capital.

Some types of public capital are easy to quantify, like tax revenue and public infrastructure. Less tangible public capital can be difficult to quantify and explain to decision makers and the public, so costs like environmental damage and social exclusion are easy to discount, at least until they grow too big to ignore.

Officials who make decisions in the public interest are also influenced by private interests. That can be subtle, via biases and blind spots, or deliberate attempts to gain private advantage by expending public capital, especially in its less tangible forms.

Citizens also tend to notice direct costs, like taxation of financial capital, more than indirect costs, like loss of social capital due to disinformation on social media.

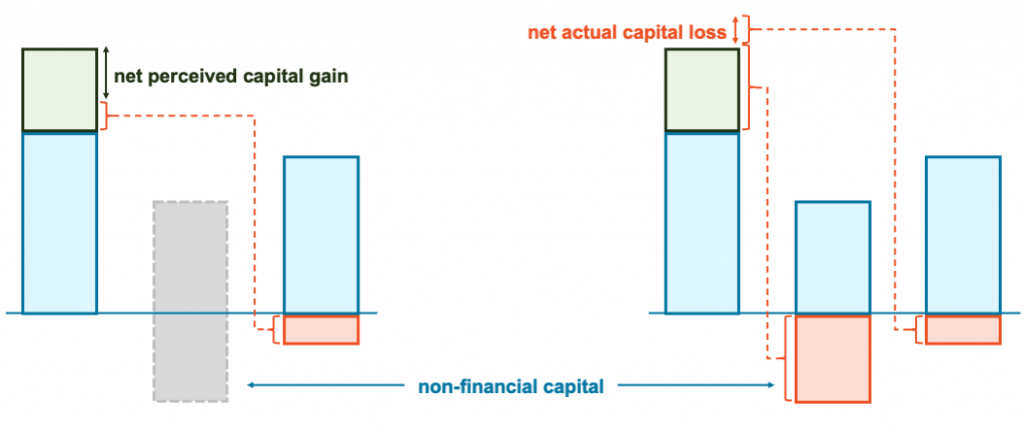

When only one or two types of capital are considered, decisions that seem fair only when some of the costs are ignored can result in a loss of net public capital. Apparently advantageous financial capital gains can hide much larger costs in natural capital, such as when environmental protection goals are subverted in the interests of profitable industries.

Losses in one type of capital can lead to escalating costs that spread to others. When public officials use their positions to gain improper financial advantage, citizens lose trust in governments and society. Those who can afford to do so are more likely to withdraw from their communities. This reduces human and social capital, like volunteering, transferring costs to governments to provide more community services.

The cost-benefit analyses that inform decisions about public capital should consider the full range of relevant capitals, not just financial capital. Understanding different types of capital can help governments to identify when and where they should intervene to control losses, such as by investing in safeguards.

Social capital is a significant enabler of public value systems. As social capital declines, government action costs more and achieves less. Understanding those interactions helps to inform appropriate investments in social cohesion and the integrity of public institutions. Some emerging models developed for other capitals, like setting prices for harms to natural capital, may also help to tackle the problems that erode social capital, like disinformation and corruption.

Considering all relevant capitals gives decision makers the information they need to increase, not decrease, net public capital. By recognising the interaction between social and financial capital in public value systems, for example, they can optimise costs and benefits across the two.

Increases in one type of capital can benefit others. Addressing erosion of social capital, such as by reducing corruption or disinformation that damage public trust, encourages citizens to contribute more human capital to engaging with their communities.

Public officials trade in all forms of public capital, whether they know it or not. They devalue the net public asset base for everyone when they ignore important factors to buy high and sell low.