Governments traditionally provided monopoly services that the private sector did not, like water supply, public transport, and capital-intensive vocational education. Modern, often complex, markets for public services invite the private sector to compete with public sector incumbents to deliver publicly funded services. But private sector operators may only provide profitable services, leaving incumbents with even higher costs and lower revenues.

In their ongoing quest to control costs, governments may turn to the private sector, which they perceive to be more efficient. Engaging with private operators can bring competitive tension to traditional monopolies like utilities, public transport, or vocational education.

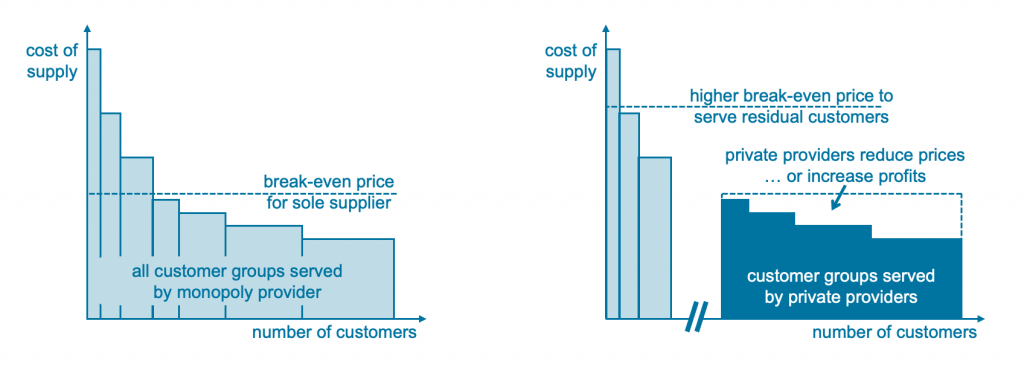

Private sector players naturally seek out the services that are most profitable for them to provide. They pick off the services, routes, or courses that are cheaper to run, or that bring in more revenue, leaving governments to carry residual or unprofitable services and provide a backstop against system shocks.

Residual public services often appear even less efficient by comparison, apparently validating the decision to outsource services that seem to be cheaper and more efficient in private hands.

For monopoly providers, lower-cost customers help to cross-subsidise the fixed costs of higher-cost (or lower revenue) services, like utilities or public transport in sparsely populated areas, or capital-intensive training like panel beating or automotive maintenance. When private operators take over lower-cost services and customers, public providers are left with a smaller customer base and higher average costs.

Higher-cost customers tend to have higher needs and vulnerabilities, like people in remote areas, people with disability, or people with language barriers. Higher unit costs increase the pressure on public providers to reduce those costs, even though vulnerable customers are often least able to afford any resulting price increases, or to cope with reductions in services.

Estimates of potential efficiency gains from privatised service delivery must consider total cost to serve all customers, not just ‘profitable’ cohorts. Otherwise, underlying cost drivers can result in higher costs or reduced services for people who can least afford it.

Once effective subsidies from lower-cost customers and services are considered, the efficiency gains of privatisation may be reduced, or even eliminated. If a compelling business case for private delivery remains, then partnerships with private providers should include guarantees of service standards and price stability for all customers, regardless of the provider. Price rises and service cuts are not benefits. Actual efficiencies can only be calculated when all customers’ needs are met, including the most vulnerable and costly to serve.

Outsourcing and competition strategies need to consider the underlying cost drivers of a service and the mechanisms by which private operators, or greater competition, will affect service price, quality, and equity. Bringing new bidders to the table can lower costs, but if the key driver is customer selection rather than service efficiency, then this can be a false economy. Robust analysis should be based on aggregate costs for the whole service system to serve all customers, including measures of service quality.

The private sector already carves off the profitable parts of any market. Service outsourcing adds a layer of public funding gravy to attract private players into the least unprofitable parts of what remains, increasing the risk of private sector profiteers feathering their nests while treating the public like turkeys.